A customer using Autotres has become a 10 million yen player.

We interviewed the customer and would like to introduce it to you.

We hope that this will be an opportunity for the culture of automated trading to flourish in Japan.

.

Automate your investments

Automatic Trade Co., Ltd.

Hiroshi Matsumura

.

・

I couldn’t be more pleased that the day has come when I can share this news with my readers.

A way to earn money without being bound by time is something that will undoubtedly be needed by many people living in Japan.

One of the things we advocate is automated trading of financial products.

I felt that in order for automated trading of financial products to take root in Japan and become a part of culture, a star needed to emerge.

That’s why we still provide support free of charge.

We only charge a system usage fee, and only when you actually buy or sell.

We will continue to support the team so that a second or third star player can emerge.

There may be a fee for this at some point, but please bear with me.

.

Now let me introduce you to this 10 million yen player.

He said he couldn’t reveal the name.

I first encountered Autore in 2007, the year before Autore was founded, so I have been a customer since quite some time ago.

Although he did not see much success at first, he continued to conduct demo trading and explore his methods, and eventually began actual trading.

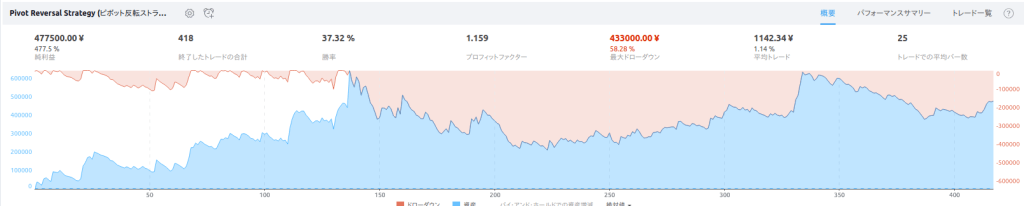

In early September 2015, profits from actual trading since the beginning of the year exceeded 10 million yen.

The transaction continues after that.

.

Now let’s introduce it through an interview.

First, let’s start with the part where you answered the questions we prepared.

(Our company) We are concerned about the future pension situation in Japan, and have started this business with the hope of producing people who can earn an income through automated trading, even as individuals, and creating a country where our children and grandchildren can live as freely as possible.

There are many different hopes for people who want to earn an income through automated trading using our company, but I believe that Mr./Ms. XX’s success will be an emotional support to those people.

Please let us feature your work on our blog and website.

Q1: Please tell us about your age group. I’m in my 60s.

Q2 Are you currently a salaried employee or have you been a salaried employee in the past? @Yes.

Q3 Please tell us about your family as much as possible. We are a married couple. Our children are already independent.

Q4 Do you currently have any other sources of income?

@I’m in my 60s and no longer work as a salaryman. Icurrently have an additional income that is enough for my husband and I to liveon. This additional income will disappear when I retire.

Q5: What made you start investing?

@I realized that my job as a salaryman was beyond my control, so I started investing in stocks in my 30s.

Q6: Has anything changed since you met Autotres?

@I have started to think logically.

Q7: Could you please tell me as much about your current methods as possible?

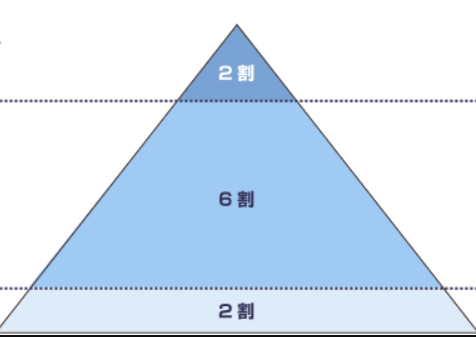

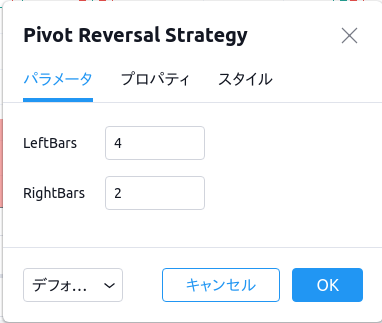

@My current method is simple and semi-automatic.I don’t make everything into rules and set it to auto.Stock investment is the process of verifying and building your own ideas one by one, and I think this process is the most important thing.I think the destination will be different for each person.

Finally, we asked them to speak freely.

I first encountered Autore in May 2007, during its early days.

At the time, I was impressed by how wonderful the system was, and that impression still feels fresh to me today.

Recently, our profits have been increasing. There will be ups and downs, but we intend to work hard to ensure that the total amount continues to increase.

It’s been about 30 years since I started investing in stocks, and during that time I have always asked myself the question of whether there are blue birds like Chiruchiru and Michiru. This question continues to this day.

I think Autore’s trading site is the only tool that can make Chiruchiru and Michiru’s journey in search of the blue bird quick and comfortable.

To use an analogy with fishing, once you have gained experience and are ready to go independent, you will need a fishing boat.

Autore provides steel, equipment, gauges, radar, fish finders, autopilots, and other items for building fishing boats. These are available in such a large and varied variety that it is almost endless.

Following the blueprints you create, you will combine these steel materials and equipment to build a fishing boat. Once constructed, you will undergo a test run and then board the boat as the captain and head out to sea. Once you have safely completed your fishing trip, you will return to your home port.

Stock investment is like fishing, a business that is run to earn a living. It is important to continue and survive as a business.

I believe that stock investment using Autotrading is well worth the effort.

“–Automate your investments–Create another stream of income–”Autore touts, and it has been very empowering so far.

I think the image will become clearer if you read it this way: “We will provide steel and equipment for building fishing boats. As our second business, we will earn a living through fishing.”

Postscript:Until now, what I most wanted to know was whether there was a blue bird like Chiruchiru and Michiru.

If we understand this, we can take on the challenge with courage.

It would be my greatest joy to be able to convey to Autore users that “maybe bluebirds do exist.”

Honestly, I’m so happy I could cry.

We hope that many talented players will emerge from among our users.

You could be next.

Autore will support you.

There is a comment section at the bottom. I would be happy if you could leave something. I will definitely reply.

.